BNPL usage tracking trends: insights for better decisions

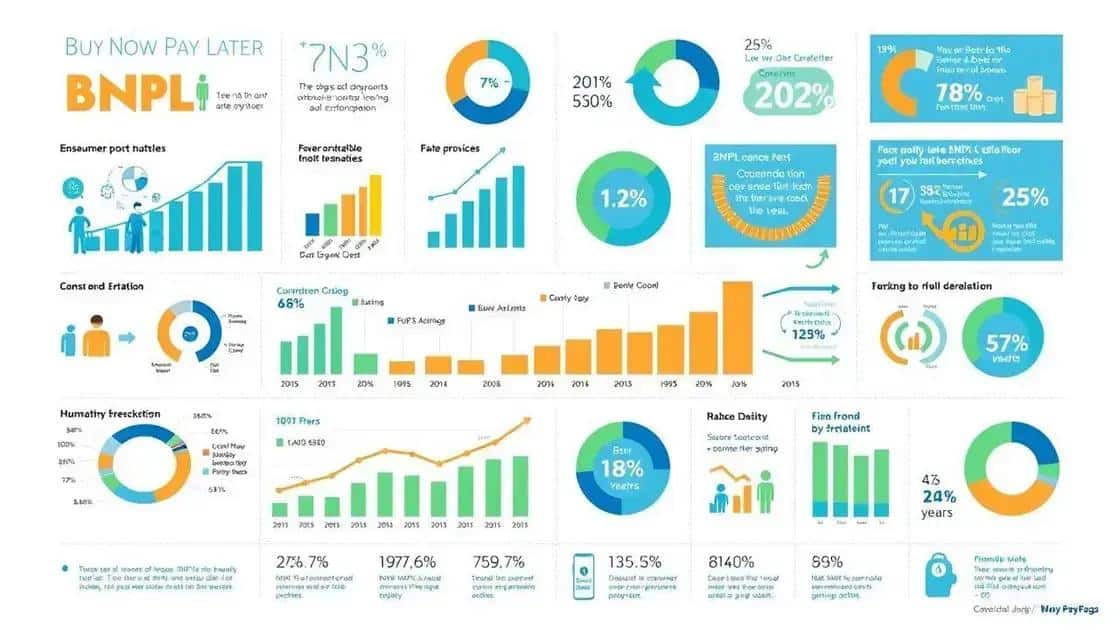

BNPL (buy now, pay later) tracking focuses on monitoring consumer usage and spending behaviors, enabling businesses to improve customer experiences and drive growth while addressing challenges in data accuracy and regulatory compliance.

BNPL usage tracking trends are shaping the future of financial interactions. As consumers increasingly opt for ‘buy now, pay later’ options, understanding these trends is essential for both individuals and businesses. What does this mean for your financial decisions?

Understanding BNPL and its impact on consumer behavior

Understanding BNPL is essential in today’s economy, where consumers have more financial options than ever. This payment method allows people to buy products while deferring payment. Its impact on consumer behavior is significant.

Many shoppers appreciate the flexibility that BNPL provides. For instance, they can spread the cost over weeks or months without paying interest, making larger purchases more manageable. This option often leads to increased spending and encourages impulsive buying.

The appeal of BNPL

Why do so many consumers choose BNPL? Here are some reasons:

- Easy application process with minimal checks

- Instant approval and access to funds

- Ability to shop now and pay later without upfront costs

As we dive deeper into consumer choices, we notice that BNPL resonates well with younger generations. They are more inclined to adopt modern financial solutions. This trend shifts their shopping habits, favoring online retail and digital transactions.

Effects on spending habits

Moreover, BNPL may alter how people manage their budgets. Many users enjoy the freedom it offers but may overlook potential fees and late charges. Therefore, understanding the responsibilities that come with this payment method is crucial.

- Monthly budgeting can become challenging

- Users might incur debt if they are not careful

- Late fees can add to the overall cost

In conclusion, while BNPL makes purchasing easier, consumers must stay informed about its effects on their financial health. It’s important to strike a balance between enjoying flexibility and managing financial responsibilities effectively.

Key trends in BNPL usage tracking over the years

Key trends in BNPL usage tracking have evolved significantly over recent years. As more consumers turn to flexible payment options, understanding these trends helps both businesses and individuals make informed decisions.

One noticeable shift is the rise in mobile usage. Many consumers prefer shopping via smartphones and tablets. This convenience has contributed to the growth of BNPL as a seamless payment solution.

Increasing popularity among younger consumers

Data indicates that younger shoppers are embracing BNPL more than other age groups. They appreciate the ability to manage payments effectively without high-interest fees. This demographic is likely to continue fueling the growth of BNPL services.

- Flexibility in payments resonates with budget-conscious consumers.

- Instant access to credit encourages more spontaneous purchases.

- Social media marketing influences trends and awareness.

Another trend is the emergence of more retailers offering BNPL options. Major brands are integrating these services to attract customers. This competitive landscape fosters better deals and increased accessibility for shoppers.

Regulatory changes

Regulatory changes are also shaping the BNPL landscape. As more countries examine the impact of BNPL on consumers, businesses face new requirements for transparency and reporting. Understanding these regulations is essential for companies involved in BNPL.

- Restrictions on fees and interest rates are becoming common.

- Greater emphasis on educating consumers regarding debts.

- Impact assessments ensure consumer protection.

In summary, tracking these key trends allows stakeholders to adapt to the evolving BNPL landscape. Monitoring consumer behavior and regulatory shifts is vital for long-term success in the industry.

How businesses can leverage BNPL data for growth

How businesses can leverage BNPL data for growth is a crucial topic. Many companies now recognize the potential of using data from buy now, pay later services to enhance their strategies.

By analyzing BNPL data, businesses gain important insights into consumer behavior. This data reveals purchasing trends, consumer preferences, and spending patterns. Understanding these nuances helps companies tailor their marketing strategies effectively.

Targeted marketing strategies

One way to leverage BNPL data is through targeted marketing campaigns. Companies can use insights from this data to identify and reach specific consumer segments. For example, by knowing who is using BNPL services, businesses can create promotions that appeal directly to those customers.

- Design campaigns that highlight BNPL options.

- Offer personalized discounts based on purchase history.

- Engage users with tailored content on social media.

Moreover, businesses can enhance their product offerings based on BNPL insights. If data shows that certain items are frequently purchased together, companies can create bundles or special deals to increase sales.

Improving customer experience

Improving the overall customer experience is another key area. By analyzing BNPL data, businesses can identify pain points in the purchasing process. This involves understanding where customers might hesitate or abandon their carts. Business owners can then address these issues by streamlining the checkout process.

- Reduce friction in the payment process.

- Provide clear information about fees and terms.

- Enhance customer support related to BNPL transactions.

As companies put these strategies in place, they not only utilize BNPL data effectively but also build stronger relationships with their customers. Increased trust and satisfaction can drive repeat purchases and boost overall revenue.

Challenges in BNPL tracking and reporting

Challenges in BNPL tracking and reporting are significant for businesses and financial institutions. As the popularity of buy now, pay later options grows, so do the complexities involved in managing them.

One major challenge is data accuracy. Companies must ensure that the information they collect is reliable. Inaccurate data can lead to misguided decisions, affecting both marketing strategies and customer satisfaction.

Regulatory compliance

Another issue involves regulatory compliance. Various countries are setting stricter guidelines for BNPL services. Businesses must stay updated on these regulations to avoid penalties. This requires resources and the ability to continuously adapt to new rules.

- Understanding local laws regarding interest rates and fees.

- Ensuring transparency in reporting to consumers.

- Implementing necessary changes in data management practices.

Furthermore, tracking consumer behavior accurately poses challenges. Companies need to analyze patterns in BNPL usage without infringing on user privacy. Balancing data collection with respect for consumer rights is crucial.

Integration with existing systems

Integrating BNPL tracking with existing financial systems can also be complicated. Companies often rely on multiple systems to manage their payments and transactions. Ensuring that all systems work together seamlessly is essential for accurate reporting and analysis.

- Interoperability between different software and platforms.

- Training staff to use new tools effectively.

- Streamlining processes to improve efficiency.

These challenges highlight the need for businesses to invest in effective BNPL tracking systems. Addressing these issues will not only improve operational efficiency but also enhance customer trust.

In conclusion, understanding the challenges in BNPL tracking and reporting is essential for companies to thrive in this evolving market. As businesses embrace BNPL solutions, they must prioritize data accuracy and regulatory compliance. By effectively leveraging BNPL data, companies can improve customer experiences and drive growth. Overcoming these challenges not only strengthens operational efficiency but also enhances trust with consumers. Adopting robust tracking systems is crucial for future success.

FAQ – Frequently Asked Questions about BNPL Tracking and Reporting

What is BNPL tracking?

BNPL tracking involves monitoring consumer usage of buy now, pay later services to gain insights into spending habits and preferences.

Why is data accuracy important in BNPL reporting?

Accurate data ensures that businesses make informed decisions, which can enhance customer satisfaction and improve marketing strategies.

What are the main regulatory challenges for BNPL services?

Regulatory challenges include staying compliant with local laws regarding fees and interest rates while ensuring transparency for consumers.

How can businesses improve system integration for BNPL?

To improve integration, businesses should focus on ensuring that their BNPL services work seamlessly with existing financial systems and staff training.