2025 FAFSA Changes: Maximize Federal Aid Eligibility

The 2025 FAFSA introduces significant changes, including a simplified application and new eligibility calculations, requiring students to understand these updates to maximize their federal financial aid opportunities.

Preparing for college can be an exciting yet daunting journey, especially when it comes to understanding financial aid. The upcoming 2025 FAFSA changes are set to transform how federal student aid is calculated and awarded, impacting countless US students. This guide aims to demystify these critical updates, offering a clear, step-by-step approach to help you navigate the new landscape and maximize your federal aid eligibility.

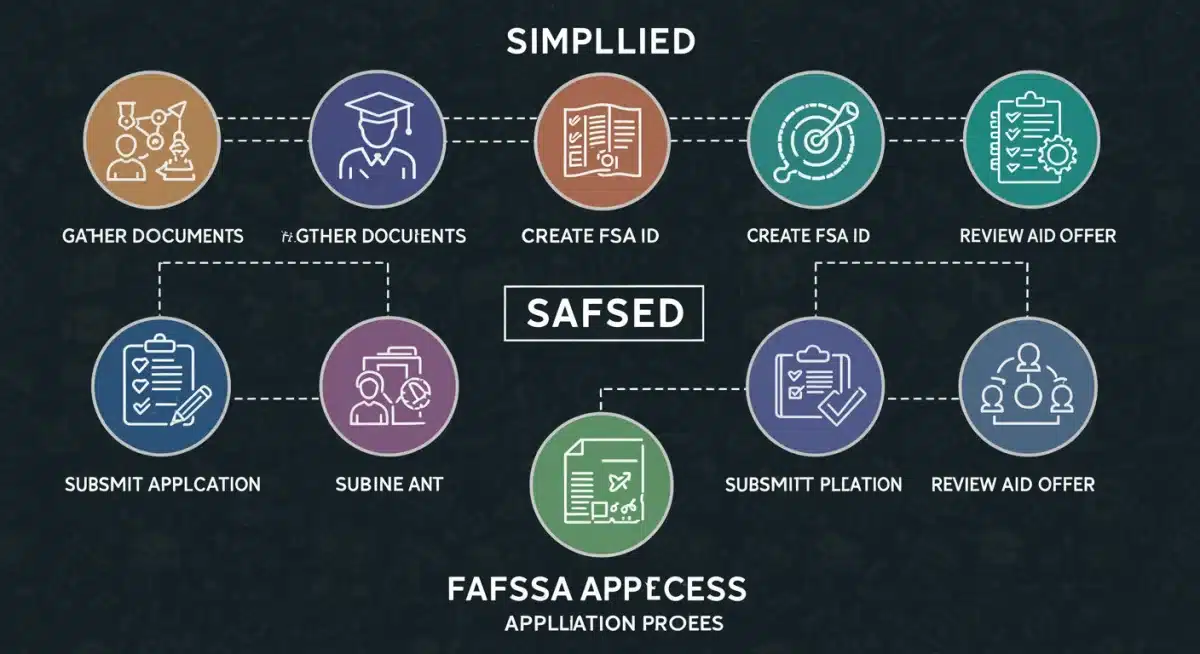

Understanding the FAFSA Simplification Act

The FAFSA Simplification Act represents a comprehensive overhaul of the federal student aid application process. Enacted to make applying for financial aid easier and more equitable, these changes will significantly alter how students and families interact with the FAFSA. It’s not just about a new form; it’s about a new approach to determining financial need and awarding aid.

This act aims to streamline the application, expand federal Pell Grant eligibility, and provide a more accurate assessment of a family’s ability to pay for college. For students, understanding these foundational shifts is the first step towards successfully securing the aid they need.

key changes introduced by the act

Several key modifications are central to the FAFSA Simplification Act. These include changes to terminology, the formula used for calculating aid, and who is required to provide financial information.

- New Terminology: The Expected Family Contribution (EFC) is replaced by the Student Aid Index (SAI). The SAI is a new eligibility index used to determine how much federal student aid a student is eligible to receive.

- Simplified Application: The number of questions on the FAFSA form has been significantly reduced, making the application process faster and less cumbersome for most applicants.

- Expanded Pell Grant Eligibility: More students, particularly those from low-income backgrounds, will qualify for Pell Grants. Eligibility will be tied to federal poverty levels and family size.

- Direct Data Exchange: The IRS Direct Data Exchange (DDX) will be mandatory for all contributors, simplifying tax data retrieval and reducing errors.

Grasping these fundamental changes is crucial for any student or family beginning the financial aid application process for the 2025-2026 academic year. The goal is to make aid more accessible, but understanding the new rules is vital.

Preparing for the 2025 FAFSA Application

Effective preparation is key to a smooth FAFSA application process. With the new 2025 FAFSA changes, some preparatory steps have become even more critical. Starting early and gathering the right information can save a lot of stress and ensure you don’t miss out on potential aid.

This section outlines the essential documents and information you’ll need to have ready before you even begin filling out the form. Being organized will not only expedite the process but also help prevent common mistakes that could delay your aid package.

essential documents and information to gather

Before sitting down to complete the FAFSA, ensure you have access to the following:

- FSA ID: Both the student and at least one parent (if applicable) must have an FSA ID. This is your username and password for federal student aid websites and acts as your legal signature. If you don’t have one, create it well in advance.

- Social Security Numbers: For the student and all parents/guardians contributing financial information.

- Federal Tax Information: The FAFSA for 2025-2026 will use 2023 tax information. Ensure you and your parents/guardians have access to your 2023 federal tax returns. The IRS Direct Data Exchange (DDX) will directly import this data, but having the physical documents can be helpful for verification.

- Records of Untaxed Income: This includes child support received, interest income, and veterans’ non-education benefits.

- Asset Information: Current balances of cash, savings, and checking accounts, as well as the net worth of investments, businesses, and real estate (excluding the family’s primary residence).

Having these documents organized and readily available will make the application process much more efficient, allowing you to accurately provide the necessary information when prompted.

Navigating the New FAFSA Application Form

The 2025 FAFSA application form itself has undergone significant revisions, designed to be more user-friendly and less time-consuming. Understanding the flow of the new form and specific sections will help you complete it accurately and efficiently.

While the goal is simplification, familiarity with the new interface and question types is beneficial. This section will guide you through the key aspects of the redesigned application, ensuring you’re well-prepared for what to expect.

key aspects of the redesigned application

The new FAFSA form focuses on clarity and reducing redundant questions. Here’s what to look out for:

- Contributor Role: The FAFSA now identifies “contributors” – anyone required to provide information on the form (student, spouse, parent(s), stepparent). Each contributor will need an FSA ID and will provide consent for their tax data to be transferred via the IRS DDX.

- Direct Data Exchange (DDX): This is perhaps the most significant change. Instead of manually entering tax information, the DDX will securely transfer your 2023 federal tax data directly from the IRS. This is mandatory for all contributors.

- Fewer Questions: The number of questions has been drastically cut from over 100 to about 36 for most applicants. This simplification aims to reduce confusion and errors.

The streamlined process, particularly the mandatory DDX, is intended to reduce the burden on applicants and improve data accuracy. Being aware of these changes will allow you to navigate the form with confidence.

Understanding the Student Aid Index (SAI)

One of the most impactful 2025 FAFSA changes is the replacement of the Expected Family Contribution (EFC) with the Student Aid Index (SAI). The SAI is a new number that colleges use to determine how much federal student aid a student is eligible to receive. It’s a fundamental shift in how financial need is assessed.

Understanding how the SAI is calculated and what factors influence it is crucial for maximizing your federal aid eligibility. This section will delve into the intricacies of the SAI, providing insights into its calculation and its implications for your financial aid package.

how the sai is calculated and its impact

The SAI calculation incorporates several factors, with some notable differences from the old EFC:

- Income Assessment: The new formula places a greater emphasis on income, particularly adjusted gross income (AGI), as reported through the IRS DDX.

- Family Size: The FAFSA will pull family size directly from federal tax returns. However, applicants can update this number if it has changed since the tax filing.

- Pell Grant Eligibility: The SAI now directly impacts Pell Grant eligibility, with a minimum and maximum Pell Grant amount determined by family size relative to the federal poverty level. This means more students may qualify for Pell Grants.

- Negative SAI: Unlike the EFC, the SAI can be a negative number, ranging from -1500 to 999999. A negative SAI indicates a higher level of financial need and could lead to increased aid eligibility.

The shift to SAI aims to provide a more holistic and equitable assessment of a family’s financial situation, potentially opening up federal aid opportunities for more students, especially those with significant financial need. Understanding your potential SAI is a key step in planning for college costs.

Maximizing Your Federal Aid Eligibility

With the 2025 FAFSA changes, there are new strategies and considerations for maximizing your federal financial aid eligibility. Beyond simply filling out the form accurately, proactive steps can significantly impact the amount of aid you receive. It’s about being informed and strategic.

This section will provide actionable advice and insights into how students and families can best position themselves to receive the maximum possible federal aid under the new FAFSA guidelines. From understanding specific aid programs to navigating special circumstances, every piece of information helps.

strategies for increasing your aid package

To optimize your federal aid:

- Complete FAFSA Early: While the federal deadline is often later, many states and colleges have their own priority deadlines. Submitting early can be crucial for state and institutional aid, which might be awarded on a first-come, first-served basis.

- Understand Special Circumstances: If your family’s financial situation has changed significantly since the 2023 tax year (e.g., job loss, medical expenses, divorce), contact your college’s financial aid office. They may be able to make professional judgment adjustments to your SAI.

- Consider College Costs: Different colleges have different costs of attendance and varying financial aid policies. Researching and applying to a range of schools can increase your chances of receiving a favorable aid package.

- Know Your Aid Options: Familiarize yourself with different types of federal aid, including Pell Grants, Federal Supplemental Educational Opportunity Grants (FSEOG), Federal Work-Study, and Direct Subsidized and Unsubsidized Loans.

Being proactive and informed about these strategies will empower you to navigate the financial aid process effectively and secure the federal assistance you deserve.

Post-Submission: What to Expect Next

Submitting your FAFSA is just the first major step. After the application is sent, there’s a period of waiting, followed by reviewing your aid offer and making informed decisions. The 2025 FAFSA changes also impact the post-submission phase, particularly how aid offers are presented and understood.

This section will guide you through what happens after you hit ‘submit,’ from receiving your FAFSA Submission Summary to understanding your financial aid award letters from colleges. Knowing what to expect will help you plan your next moves and ensure you’re well-prepared for college enrollment.

reviewing your aid offer and next steps

Once you’ve submitted your FAFSA, here’s what to expect:

- FAFSA Submission Summary: This replaces the Student Aid Report (SAR). It provides a summary of the data you submitted and your calculated Student Aid Index (SAI). Review this document carefully for any errors.

- Financial Aid Offer Letters: Colleges you’ve applied to and listed on your FAFSA will use your SAI to create financial aid offer letters. These letters detail the types and amounts of aid (grants, scholarships, loans, work-study) you’re eligible for at that specific institution.

- Comparing Offers: It’s crucial to compare aid offers from different schools. Look beyond just the sticker price and focus on the net price – the actual cost you’ll pay after grants and scholarships are applied.

- Accepting Aid: Each college will have a process for accepting or declining various components of your aid package. Be mindful of deadlines and only accept what you truly need, especially with loans.

The post-submission phase requires careful review and consideration. Understanding your FAFSA Submission Summary and thoroughly evaluating financial aid offers are essential steps toward making informed decisions about your higher education funding.

| Key Change | Brief Description |

|---|---|

| EFC to SAI | Expected Family Contribution (EFC) is replaced by the Student Aid Index (SAI), a new eligibility metric. |

| Simplified Application | Fewer questions (around 36) make the application process faster and less complex. |

| IRS Direct Data Exchange | Mandatory direct transfer of tax data from the IRS, improving accuracy and efficiency. |

| Expanded Pell Grant | Increased eligibility for Pell Grants, particularly for low-income students, tied to poverty levels. |

Frequently Asked Questions About 2025 FAFSA

The most significant change is the replacement of the Expected Family Contribution (EFC) with the Student Aid Index (SAI). Also, the application is much shorter, and the IRS Direct Data Exchange (DDX) is mandatory for all financial contributors.

Although the exact opening date for the 2025-2026 FAFSA is typically in December, it is always recommended to complete it as soon as possible after it opens. Many states and colleges have priority deadlines that impact aid availability.

Yes, all contributors, including parents (if applicable), will need their own FSA ID to access the FAFSA and provide consent for the IRS Direct Data Exchange. Create these well in advance to avoid delays.

The 2025-2026 FAFSA will use your 2023 federal tax information. This is retrieved directly from the IRS using the mandatory Direct Data Exchange (DDX), simplifying the process and reducing potential errors.

Yes, a negative SAI (which can go as low as -1500) indicates a higher level of financial need. This can lead to increased eligibility for federal student aid, including Pell Grants, and a more robust financial aid package.

Conclusion

The 2025 FAFSA changes represent a significant evolution in federal student aid, designed to simplify the application process and expand access to financial assistance. By understanding the shift from EFC to SAI, preparing with the right documents, and navigating the new application form effectively, US students can maximize their eligibility for federal aid. Proactive engagement with these updates, from early submission to careful review of aid offers, is paramount to securing the financial support needed for higher education. These changes, while initially requiring adjustment, ultimately aim to make college more affordable and accessible for a broader range of students and families.