Insights on emergency fund best practices to secure your future

An emergency fund is a dedicated savings account for unexpected expenses, typically recommending three to six months’ worth of living costs to ensure financial security in times of crisis.

Insights on emergency fund best practices reveal essential strategies for financial well-being. Have you ever wondered how prepared you would be for unexpected situations? Let’s dive into how you can build a strong safety net.

Understanding what an emergency fund is

An emergency fund is a crucial aspect of financial planning. It’s a savings account set aside for unexpected expenses, such as medical emergencies, car repairs, or job loss. By having this fund, you can avoid going into debt when unforeseen situations arise. Let’s break down what you need to know about building and maintaining a solid emergency fund.

Purpose of an Emergency Fund

The primary purpose of an emergency fund is to provide financial security. It acts as a safety net, ensuring that a sudden expense won’t derail your finances. Here are some key reasons why you should prioritize an emergency fund:

- Protects against unexpected expenses

- Reduces financial stress during emergencies

- Prevents reliance on credit cards or loans

Building your emergency fund might seem daunting, but it’s essential for long-term financial health. Start by determining how much you need. A common recommendation is to save three to six months’ worth of living expenses.

How to Build Your Emergency Fund

Consider automating your savings by setting up regular transfers from your checking account to your emergency fund. This strategy helps you save consistently without having to think about it.

Remember, even small contributions add up over time. If you’re struggling to save enough, consider cutting back on non-essential expenses to fast-track your savings. It’s about making conscious decisions to prioritize your financial security.

Being proactive about your money management can help you achieve your savings goals. Monitor your progress regularly and adjust your contributions as your financial situation changes.

In summary, an emergency fund is an essential tool for anyone aiming to maintain financial stability. With careful planning and consistent saving, you can build a fund that provides peace of mind during life’s unexpected events.

How much should you save in your emergency fund?

Determining how much you should save in your emergency fund is an essential step toward financial stability. Experts generally recommend setting aside three to six months’ worth of living expenses. This amount provides a buffer against unexpected financial setbacks.

Calculating Your Emergency Fund Needs

To figure out your ideal emergency fund, start by analyzing your monthly expenses. Include essentials like:

- Housing costs (rent or mortgage)

- Utilities (electricity, water, internet)

- Food and groceries

- Transportation costs

Add these figures together to get a clear view of your average monthly spending. By multiplying this total by three to six, you create a target for your emergency fund. For instance, if your monthly expenses total $2,000, aim for a fund ranging from $6,000 to $12,000.

Remember, your situation may differ based on your lifestyle and financial obligations. If you have a stable job, you might lean toward the lower end of that range. However, if your job is less stable or you have dependents, consider saving more for extra security.

Adjusting Your Fund Over Time

Your financial needs will change over time, making it important to review your emergency fund regularly. If you change jobs, move, or have children, adjust your target amount accordingly. It’s a good practice to reassess your emergency fund annually. This helps ensure you’re prepared for any changes in your circumstances.

Establishing a robust emergency fund is a proactive step toward achieving financial well-being. By tapping into resources and tools, you can build and maintain this essential financial safety net.

Where to keep your emergency fund

Deciding where to keep your emergency fund is just as important as determining the amount. The right account can help you grow your savings while ensuring easy access when you need it most. Here, we will explore various options that can keep your money safe and accessible.

High-Yield Savings Accounts

A high-yield savings account is one of the best places to stash your emergency fund. These accounts typically offer better interest rates compared to traditional savings accounts. This means your money can grow faster while being easily accessible. Look for accounts with no monthly fees and make sure they are FDIC-insured for safety.

Money Market Accounts

Another option to consider is a money market account. Similar to savings accounts, they often provide higher interest rates. Plus, many of these accounts come with check-writing privileges and debit cards, making it convenient when you need immediate access to funds.

Certificates of Deposit (CDs)

If you can afford to set aside your money for a short period, consider using a certificate of deposit (CD). CDs usually offer higher interest rates than savings accounts. However, they require you to lock in your funds for a specified term, like six months or a year. This option can work well if you set aside a portion of your emergency fund in a CD while keeping the rest liquid in a savings account for immediate use.

Regardless of where you keep your emergency fund, ensure that you have quick access to it. Life’s unexpected events often require immediate action, and having your money easily reachable can alleviate stress during challenging times. Regularly reviewing your chosen savings method is also wise, allowing adjustments if needed.

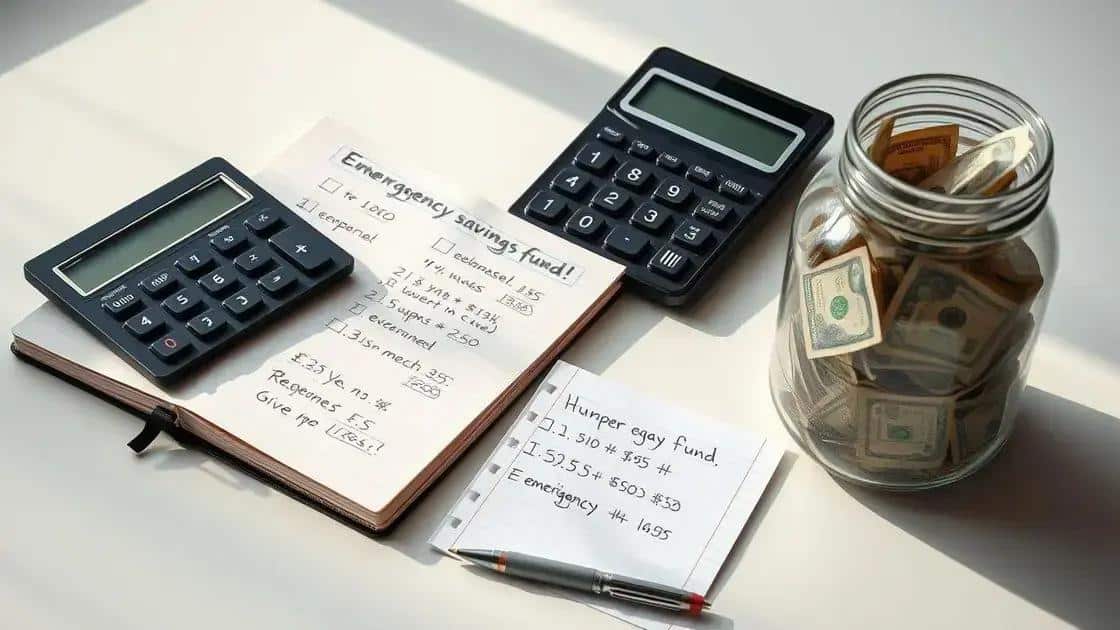

Tips for growing your emergency fund

Growing your emergency fund is a vital step in securing your financial future. With the right strategies, you can boost your savings quickly and efficiently. Here are some effective tips to help you expand your fund.

Set a Monthly Savings Goal

Determine how much you can realistically save each month. Setting a specific goal helps you stay motivated and accountable. For instance, if you aim to save $200 each month, this will add up to $2,400 in a year!

Automate Your Savings

One of the easiest ways to grow your emergency fund is to automate your savings. Set up a recurring transfer from your checking account to your savings account. This way, you won’t have to think about it; the money will be saved before you even notice it missing.

Cut Unnecessary Expenses

Review your monthly expenses and identify areas where you can cut back. Consider reducing dining out, subscriptions, or impulse purchases. Here are some common areas to examine:

- Eating out

- Streaming services

- Shopping for non-essentials

Redirect these savings directly into your emergency fund to help it grow faster.

Use Windfalls Wisely

Whenever you receive extra money, like a tax refund, bonus, or gift, consider putting a portion into your emergency fund. These unexpected funds can significantly boost your savings, helping you reach your goals quicker.

Remember, growing your emergency fund takes time and dedication. Stay focused on your savings goals, and periodically reassess your plan to ensure you’re on track. By following these tips, you will create a strong financial buffer that prepares you for life’s uncertainties.

FAQ – Frequently Asked Questions about Emergency Funds

What is an emergency fund?

An emergency fund is a savings account set aside specifically for unexpected expenses, such as medical emergencies or job loss.

How much should I save in my emergency fund?

It’s generally recommended to save three to six months’ worth of living expenses in your emergency fund.

Where is the best place to keep my emergency fund?

High-yield savings accounts or money market accounts are ideal for keeping your emergency fund safe and accessible.

What are some tips for growing my emergency fund?

Set monthly savings goals, automate your savings, cut unnecessary expenses, and use windfalls wisely to boost your emergency fund.